lhdn stamp duty rate

Such assignments had all along been imposed a nominal stamp duty of RM1000 per. On the First 5000 Next 15000.

Do You Need To Declare Your Rental Income To Lhdn

Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

. Wakalah or Agency Fee. HASiL Revenue Service Centre Operating Hours. Relief From Stamp Duty.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Where the rate provided in the ITA 1967 is lower than the DTA rate the lower rate shall apply. Rate 112010 - 31122011.

Stamp Duty Exemption Order. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

LHDN RPGT amendment under Budget 2022. HASiL Revenue Service Centre Operating Hours. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. According to the Inland Revenue Board LHDN the stamp duty exemption claim under the Home Ownership Campaign HOC is RM9578mil. HASiL Revenue Service Centre Operating Hours.

Only tax resident individual entitles for progressive tax rates personal reliefdeductions and rebates. Therefore by adding up your income from the various classes you can determine your tax rate. E-B Slip by LHDN.

The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. HASiL Revenue Service Centre Operating Hours. RPGT rate for disposal of chargeable asset under Part I Schedule 5 RPGT Act.

HASiL Revenue Service Centre Operating Hours. Real Property Gains Tax RPGT Rates. Scroll down to see a sample calculation.

Wakalah or agency fee of RM2830. Stamp Duty Exemption Order. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967.

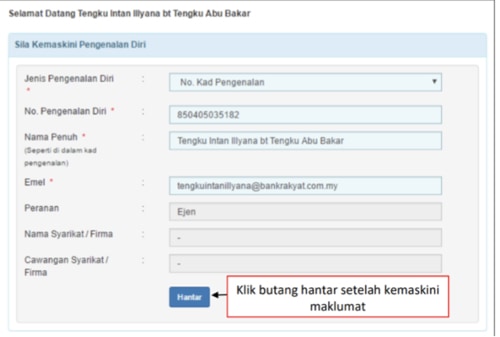

Salary Transfer To Bank Rakyat. HASiL Revenue Service Centre Operating Hours. The rate of duty varies according to the nature of the instruments and the consideration stipulated in the instruments or the market value of the property.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Form 14A Transfer of Ownership is signed by the developer. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967.

HASiL Stamp Duty Counter Operating Hours. On the First 5000. To get the best deal among the listed contractors customers are advised to liaise and request for quotations prior to appointing one.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. HASiL Stamp Duty Counter Operating Hours. Lembaga Hasil Dalam Negeri LHDN has implemented a new rate for stamp duty of assignments of life insurance policies mainly where it is for love and affection where LHDN now assesses the stamp duty on an ad valorem rate using the value of the sum assured.

S P Setias Legasi IV achieves 100 take-up rate. Stamp duty is paid at LHDN. Purchase of basic supporting equipment for disabled self spouse child or parent.

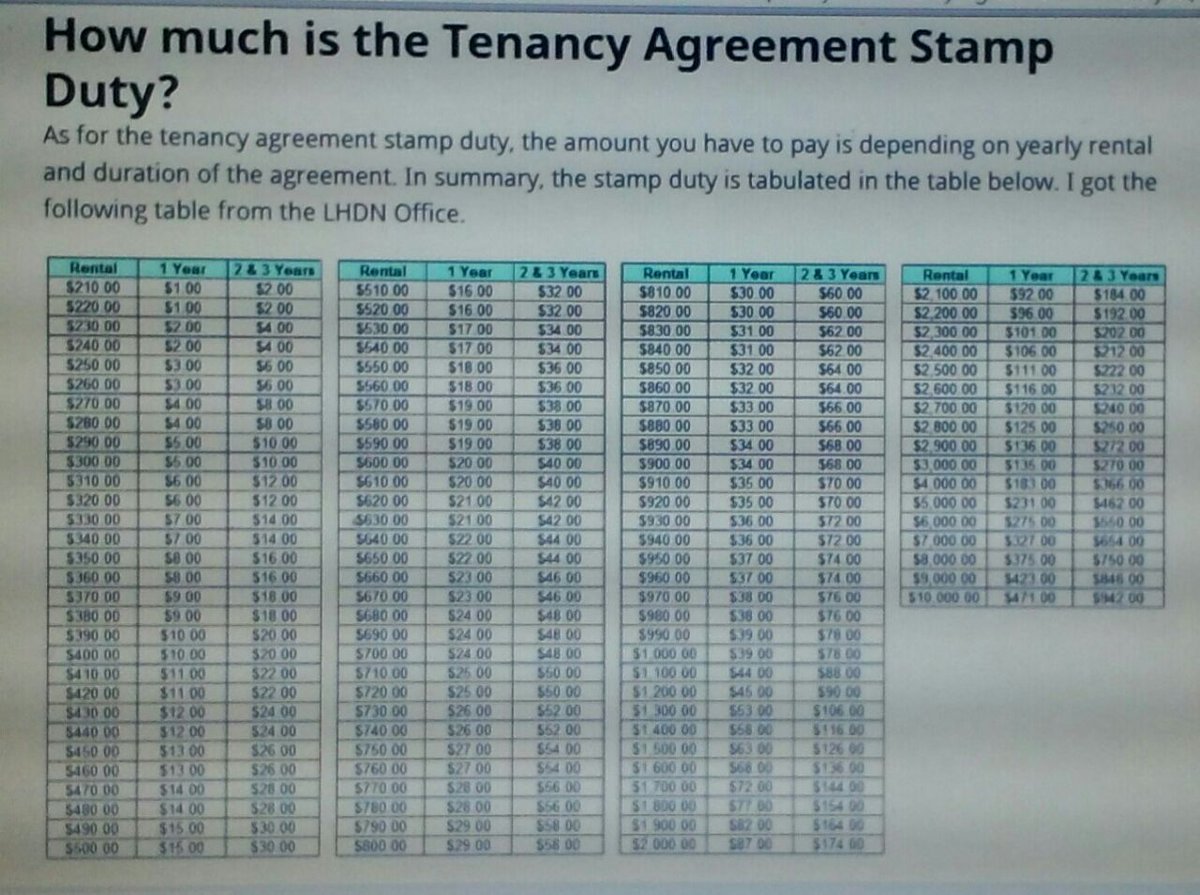

05 stamp duty fee is applicable. Stay in Malaysia less than 182 days are taxed at flat rate of 28 without any personal reliefsdeductions and rebates. Based on the table below this means that for tenancy periods less than 1 year the stamp duty fee is RM1 per RM250.

Latest BBE Form with validated payment slipreceipt to LHDN. HASiL Stamp Duty Counter Operating Hours. HASiL Revenue Service Centre Operating Hours.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B. 05 of total financing as contained in the Stamp Duty Act 1949. Currently under this category customers are required to pay upfront all these essential charges which include the Connection Charges Stamp Duty and Security Deposit to apply for electricity.

Stamp Duty Exemption Order. HASiL Stamp Duty Counter Operating Hours. The Malaysia Inland Revenue Authority also known as Lembaga Hasil Dalam Negeri Malaysia LHDN Malaysia is where you pay your.

The Maybank Islamic Personal Financing-i offers a rate starting from 65 per annum for higher financing amount with tenure between 2 and 6 years. If your tenancy period is between 1 3 years the stamp duty fee is RM2 per RM250. Calculations RM Rate TaxRM A.

How to calculate RPGT and what kind of impact does. Stamp Duty Exemption Order. Education fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology.

Form 14A Transfer of Ownership is signed by the purchaser. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Other fees and charges Late Payment Charges 1 on outstanding financing amount. HASiL Stamp Duty Counter Operating Hours. 2B-LHDN-01 Aras 2 Pusat Transformasi Bandar UTC KOMTAR 10100 George Town Pulau Pinang.

Stamp Duty Exemption Order. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Basically the lower your income the lower your tax rate is and the less tax you will have to pay.

HASiL Stamp Duty Counter Operating Hours. Stamp Duty Exemption Order. Up to 1 Year.

No duty stamp service. HASiL Stamp Duty Counter Operating Hours. As per the Budget 2022 announcement individuals who are Malaysian citizens and permanent residents will benefit from the removal of the Real Property Gains Tax RPGT on the disposal of any residential property in the sixth year of ownership and beyond.

Effective from 1st April 2017 commercial. Rebate Ibra will be given on the deferred profit. The purchaser pays the legal fees stamp duty and disbursements accordingly.

Amendments To The Stamps Act 1949. Normally there are two copies of the tenancy agreement one copy for the landlord and another one for the tenantBoth of the copies have to be stamped by LHDN before the process of moving into a new property occurs. The current tax rate as announced under Budget 2020 starts from 0 and goes all the way up to 30.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B. HASiL Stamp Duty Counter Operating Hours. Stamp Duty Exemption Order.

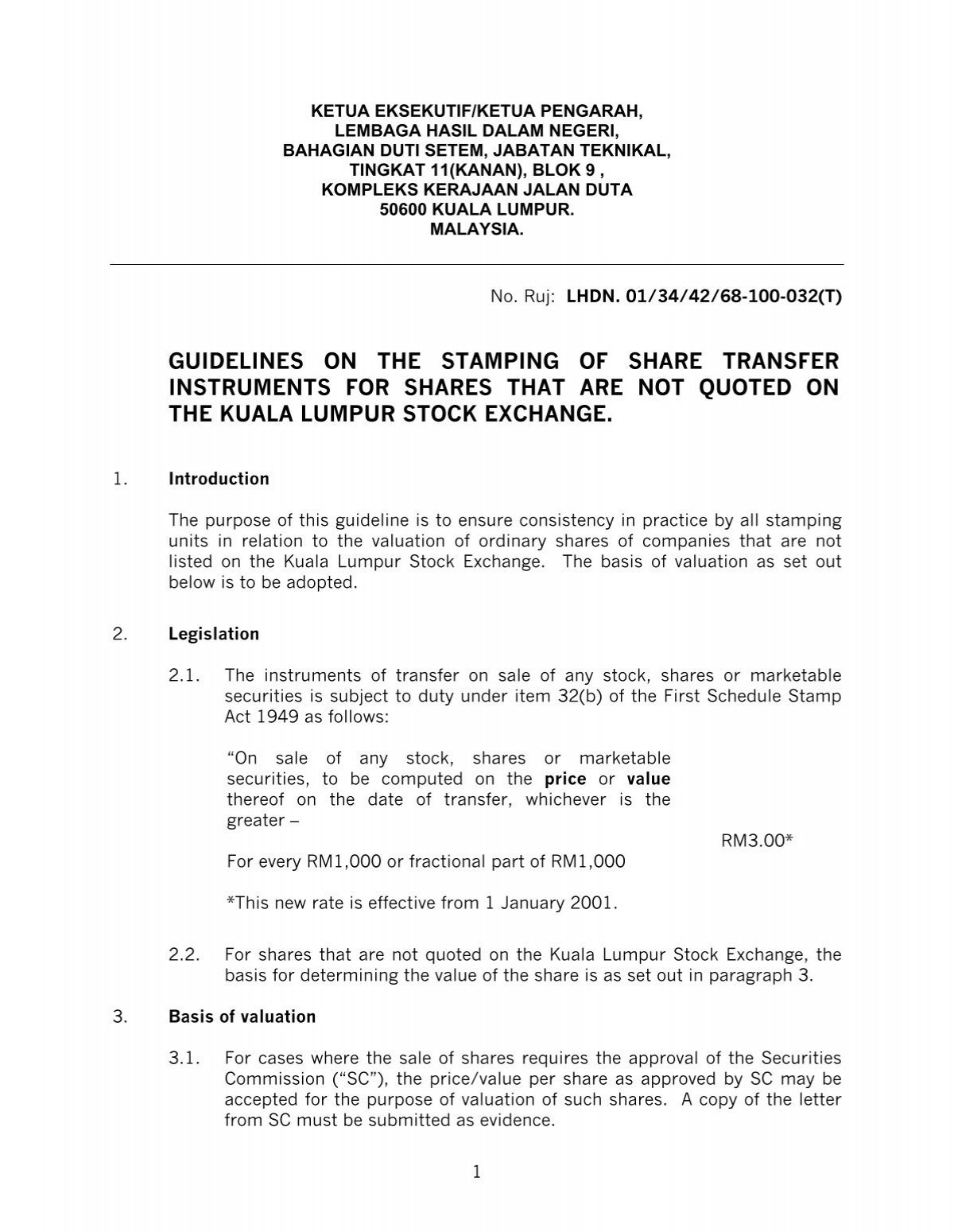

Guidelines On The Stamping Of Share Transfer Instruments

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

6 Perkara Duti Setem Malaysia 2021 Anda Kena Tahu

Urban 360 By F3 Capital Group Home Facebook

Stamp Lhdn Hasil Stamp Duty Exemption 2022 Mot Malaysia

728 A C Roessler Cachet 1933 Century Of Progress Fdc P 16a Ebay

Fundamental Of Estate Planning By Associate Professor Dr Gholamreza Zandi Ppt Download

Lhdn Tax Relief What You Need To Know Properly

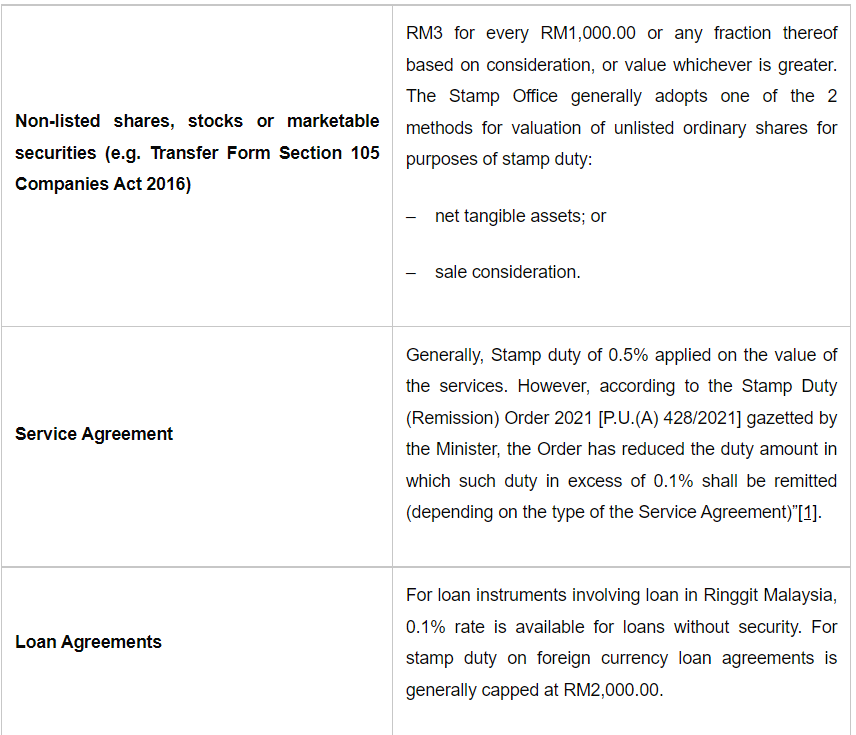

Malaysian Tax Law Stamp Duty Lexology

Fsi Tax Exemption Lifts Income Risks Of Plcs With Huge Overseas Biz

Fillable Online Iras Gov Password Reset To E Stamping Account Form Fill Out Sign Online Dochub

Suryati Hartanah On Twitter Kos Stamp Duty Lhdn Ada Rumah Nak Disewakan Cari Hana Ya 010 2275948 Https T Co Tjs9jowrax Twitter

Guidelines On The Stamping Of Share Transfer Instruments Membalik Buku Halaman 1 16 Anyflip

Lhdn Application Stamping Fees For Individual Documents Can Be Made Via Stamps From April 27 The Star

Stamp Duty In Malaysia Everything You Need To Know

Inland Revenue Board Of Malaysia In Menara Olympia Finance Sifu

Saravanan Mutheyah On Linkedin Greeting From Saravanan Co How To Calculate Tenancy Agreement Stamp

0 Response to "lhdn stamp duty rate"

Post a Comment